For this first, I offer solutions Dinar for the banking sector (especially Islamic banks) and real estate.

His case study are as follows:

So far, one of the biggest problems is the housing of the workers. They are difficult to buy a house in cash, while saving (in Rupiah) is not an intelligent solution to be able to buy a house because of the savings on average only about half the level of house price inflation.

Solutions that somewhat helps is through the installment program, which in Islamic banking schemes generally use Murabaha or sales with a profit margin agreed between the bank and its customers.

The problem is if the assumption is you wish to repay the house for Rp 200 million for 10 years for example, how much margin of profit that you will agree with your bank?.

In all likelihood the bank will calculate the profit margin 'equivalent effective interest' conventional banking on the prevailing market. If in the conventional market interest rates of 18% per year, so the profit margins of Islamic banks not far from 18% per year.

With a level profit margins 'equivalent effective interest rate' 18% / year, then for a home purchase USD 200 million per year you will repay the amount of Rp 3,600,000 / month. In total you will pay in 10 years is Rp 432 million.

So the profit margins of Islamic banks in total within ten years is Rp 432 million - USD 200 million = USD $ 232 million or 116%. !.

Fortunately, much is banking that 'sell' home to you with 116% profit margin in 10 years?. Not really, actually they are actually losing money, although the balance amount as if they were lucky - but in their real purchasing power loss.

This is the result of the use of money or 'scale' is not fair, you already feel strangled by a high bank margins - but you also lose hiccup.

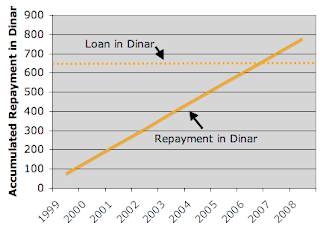

Look at the chart above when juxtaposed with the case of fair balance of all time is the Dinar. For this simulation of the accumulation of your payment into my bank pair with real price data Dinar past 10 years since 1999.

The assumption you 'buy' homes from banks USD 200 million in 1999, the dinar exchange rate was Rp 305.000 / Dinar 'purchase' You are the equivalent of 655 dinars.

After you finish installments is less than 10 years until this year, the total payment you $ 432 million. Because this year has been the dinar exchange rate of Rp 1,288,000 / Dinar; the accumulation of your payment amounting to Rp 432 million is merely equivalent to 335 dinars only. Indeed banks losing money instead of a profit even 320 dinars or 49% loss for your house!.

That is, among others, is why from time to time the global banking system in trouble, because they are operating with 'scales' bills that are not profitable when used for muamalah anyone long term.

'Purchase' You in 1999 the USD 200 million is equivalent to 655 dinars. You can agree with that no excessive profit margins for banks, for example 19% in 10 years!(Yeah right 10 years!) - Then you will pay to your bank a total of 780 dinars in 10 years or 6.5 dinars per month.

See the difference between the graphs 1 and 2. In the first graph you 'feel' suffocated but the bank still lose; in the second graph you feel lighter and banks pay for really real benefit.

How do you feel mild to pay in the Dinar?. Because in the early years of installments is only 6.5 dinars equivalent to Rp 1,985,000 / month. However if the 'purchase' in your mortgage amount the first year is USD 3,600,000, -/month.

At the end of the year-end installment loan you the dinar will be greater than the amount, for example 6.5 this year your Dinar equivalent to Rp 8,372,000, - while your installment in a fixed amount of Rp 3,600,000, -/month.

This difficult was it? probably not!.

To be able to repay Rp 3,600,000 / month in 1999 you need to have an income of at least USD 10,800,000, -. In 10 years then chances are your income is above USD 25 million, so it probably happened rising mortgage (because of the rising dinar exchange rate) in line with the increase of your income so you do not feel heavy.

Other selling points of the solution Dinar is going more and more people get home faster!, How come?.

See comparison of the above installments. In Dinar, cheaper mortgage payments in the early years. 6.5 dinar equivalent of only Rp 1,985,000. This means that people with an income of about USD 6 million per month at that time was to 'buy' a house of Rp 200 million. And with the transactions required in the amount of income to Rp 10,800,000 per month minimum.

So 'scales' just good for anyone, so already we ought to take race-based solutions Dinar ostensibly fairer.

Fellow developers and banking; Seriously think about it ... because this could be the best opportunity for you to get a superior solution in the middle of a crisis. If you do not take advantage of this superior solution may also take advantage of your competitors first. Allaah knows best